change in net working capital cash flow

Cash flow is reduced. A positive cash flow indicates that a companys cash and cash equivalents are increasing.

Schedule Of Changes In Working Capital Resume Examples Meant To Be Fund

While the working capital of that company would also decrease because the cash would be reduced current liabilities would stay.

. Step 3 Changes in Non-Cash Net Working Capital. Calculating the changes in non-cash net working capital Net Working Capital Net Working Capital NWC is the difference between a companys current assets net of cash and current liabilities net of debt on its balance sheet. If we calculate terminal value based on a year of high growth we are assuming the level of capital expenditure and working capital investment required to support the high growth will also remain at the same level perpetually which is definitely not the case when the growth rate drops to 3 at 93 growth changes in working capital is 118k.

The past years Net Cash Flow or Change in Cash and Cash Equivalents was at 607828. An increase in net working capital reduces a companys cash flow because the cash cannot be used for other purposes while it is tied up in working capital. Analyze Ciig Capital Partners Net Cash Flow or Change in Cash and Cash Equivalents.

Net working capital cash flow Cash 42 Accounts receivable 15 Inventories 18 Accounts payable 14 Accrued expenses 7 Notes payable 5 Other 2 NWC cash flow 25 Except for the interest expense and notes payable the cash flow to creditors is found in the financing activities of the accounting statement of cash flows. If the change in NWC is positive the company collects and holds onto cash earlier. We subtract out the change in WC from net income because a positive difference between new and old working capital would be a cash outflow whereas a negative difference would be a cash inflow to the firm.

The Change in Net Working Capital NWC section of the cash flow statement tracks the net change in operating assets and operating liabilities across a specified period. There are a few different methods for calculating net working capital depending on what an analyst wants to include or exclude from the value. If a transaction makes current liabilities and assets go up by the same dollar amount then there would not be any change in working capital.

However at 3 growth. Operating cash flow plus net capital spending plus the change in net working capital. Net Working Capital Current Assets less cash Current Liabilities less debt or.

The change in working capital is the difference between a firms current WC and its previous WC. A positive Change in Net Working Capital can be seen as cash outflow. Cash flow would increase by 20 billion.

Actual working capital decreases. From the current liabilities we consider. You can calculate the change in net working capital between two accounting periods to determine its effect on the companys cash flow.

The change in working capital is positive. The amount would be added to current assets without any debt added to current liabilities. Net Working Capital Current Assets Current Liabilities.

Subtract the change from cash flows for owner earnings. Working capital is defined as current assets minus current liabilities and for this blog we are assuming that the subject company utilizes an. Ciig Capital Net Cash Flow or Change in Cash and Cash Equivalents is projected to decrease significantly based on the last few years of reporting.

This can be done by taking into account the difference between the change in current assets inventory and receivables and changes in current liabilities creditors to profit. That change can either be positive or negative. Cash flow is the net amount of cash and cash equivalents transferred into and out of a business.

Intoduction to Cash Flow - Net Working Capital Manuscript Generator Search Engine. Operating cash flow is defined as. Introduction to Cash Flow - Net Working Capital.

Free cash flow is the net change in real money created by the tasks of a business during an accounting period less operating expenses for working capital dividends and capital expenditure during a similar period. Is typically the most complicated step in deriving the FCF Formula especially if the company has. This suggests that they are struggling to make ends meet and are relying on borrowing debt or equity to finance their working capital.

A negative Change in Net Working Capital basically shows cash inflow. How to Calculate Changes in Net Working CapitalStep by Step Find the Current Assets for the current year and previous year. However if the change in NWC is negative the business model of the company might require spending cash before it can sell.

So if the change in net working capital is positive it means that the company has purchased more current assets in the current period and that purchase is basically outflow of the cash. O Change in Net Working Capital NWC Current Assets - Current Liabilities o Operating Cash Flow EBIT Depreciation - Taxes O Cash Flow from Assets - Operating Cash Flow Net Capital Spending Net Capital Spending Ending Net Fixed Assets - Depreciation. An increase in net working capital must be subtracted from and a decrease in net working capital must be added to after-tax operating profit.

A firms net profit over a specified period of time. Ie Asset increase spending cash reducing cash negative change in working capital. Net working capital NWC Accounts receivables Inventory - Accounts payables Net working capital NWC Current Assets - Current Liabilities.

So a positive change in net working capital is cash outflow. Actual working capital increases. Cash flow is the net amount of money that a business entity acquires and dispenses during a timeframe.

Working capital would also increase by 20 billion. If the change in net working capital presents a positive value it means the assets of. Here comes an explanation.

Change in net working capital NWCt - NWCt-1 As long as one keeps the NWC calculation. A company uses its working capital for its daily operations. Find the Current Liability for the Current Year and Previous Year.

Cash flow to shareholders minus net capital spending plus the change in net working capital. From the point of the current asset of view we consider. It can repay liabilities reinvest in the.

Similarly change in net working capital helps us to understand the cash flow position of the company. Doing so we find. Cash flow is increased.

Net Working Capital Formula. If a company has bought a fixed asset like a building then its cash flow would go down. Since ongoing investments in accounts receivable inventory and fixed assets are typically essential to the continued operations of a business it is common to adjust free cash flow forecasts to reflect working capital changes.

Manuscript Generator Sentences Filter.

Free Cash Flow Cash Flow Cash Flow Statement Free Cash

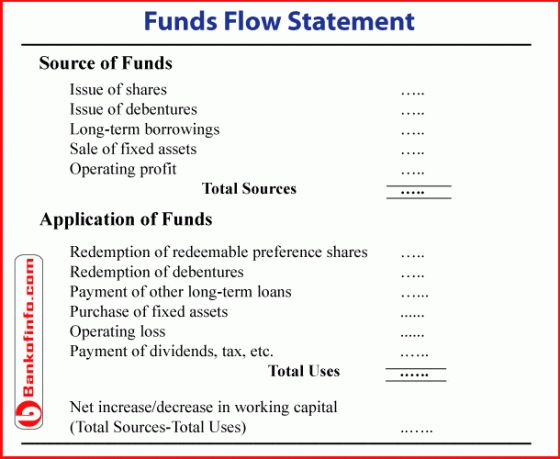

How To Prepare Fund Flow Statement Fund Flow Accounts Receivable

Cash Flow From Operating Activities Learn Accounting Accounting Education Positive Cash Flow

Image Result For Cash Flow Statement Template Contents Cash Flow Statement Financial Statement Analysis Financial Ratio

Net Cash Change Cash Flow Statement Cash Flow Cash

Operating Cash Flow Ocf Cash Flow Statement Positive Cash Flow Cash Flow

Free Cash Flow Cash Flow Free Cash Finance

Cash Flow Statement Cash Flow Statement Investing Cash Flow

Free Cash Flow Cash Flow Cash Flow Statement Positive Cash Flow

How To Prepare Fund Flow Statement Fund Cash Funds Flow

Cash Flow Statement Format Cash Flow Statement Cash Flow Accounting Basics

Cash Flow From Operating Activities 2 3 Cash Flow Statement Cash Flow Cash

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

Cash Flow Management Accounting Basics Accounting Education Economics Lessons

A Primer On Operating Cash Flow Cash Flow Cash Flow Statement Primer

Net Cash Change In Cash Flow Statement Should Tie To Cash Reported In The Balance Sheet Cash Flow Statement Cash Flow Balance Sheet

Operating Cash Flow Ocf Cash Flow Statement Cash Flow Budget Calculator

Cash Flow Formula How To Calculate Cash Flow With Examples Positive Cash Flow Cash Flow Formula

Accounting Taxation Working Capital Management Full Info Capital Requirement Operating Cycle Gross Accounting Education Financial Management Management