prince william county real estate tax payments

By creating an account you will have access to balance and account information notifications etc. Payment of the Personal Property Tax is normally due each year by October 5 see Tax Bill for due date.

National Park Service Prince William Forest Park Sign Virginia Travel Forest Park Forest Service

The system will verbally.

. When tax assessors estimate the value of your property they multiply that number by the tax rate of the county. Actual taxes might differ from the figures displayed here due to various abatement and financial assistance programs. You benefit also pay taxes online using eCheck eCheck is Prince William Countys automated payment recipient that allows you to seem real estate.

Ad Download Property Records from the Prince William County Assessors Records. Press 2 to pay Real Estate Tax. If your real estate account does not show on the My Accounts screen it is because real estate account types generally do not automatically link when registering.

The real estate tax is paid in two annual installments as shown on the tax calendar. Dial 1-888-2PAY TAX 1-888-272-9829 using a touch tone telephone. Look Up Any Address in Prince William County for a Records Report.

Have pen paper and tax bill ready before calling. The average homeowner will pay about 250 more in Real Estate taxes and fire levy taxes next year. If payment is late a 10 late payment penalty is assessed on the unpaid original tax.

Advance payments are held as a credit on your real estate personal property or. Report a Change of Address. The median property tax in Prince William County Virginia is 3402 per year for a home worth the median value of 377700.

Follow These Steps to Pay by Telephone. Prince William County collects on average 09 of a propertys. Houses 3 days ago When prompted enter Jurisdiction Code 1036 for Prince William CountyPress 1 for Personal Property TaxPress 2.

You will need to create an account or login. Tax Payments - Prince William County Virginia. You can pay a bill without logging in using this screen.

Median Property Taxes Mortgage 3893. Prince William County - Home Page. The county proposes a new 4 meals tax to be charged at restaurants.

Prince William County Property Tax Payments Annual Prince William County Virginia. What is different for each county and state is the property tax rate. Report a New Vehicle.

2 days agoPrince William County is proposing to tax meals in restaurants and increase the levy on data centers while rising property values will drive residential tax bills up nearly 5. Two options for newly. Report changes for individual accounts.

However we can assist you. Prince William County accepts advance payments from individuals and businesses. Enter the Account Number listed on the billing statement.

Enter your payment card information. Included on the real estate tax bills is the special district tax for the gypsy moth. Press 1 to pay Personal Property Tax.

See Results in Minutes. 2 days agoLocal taxes could go up again in Prince William County in the coming year under a proposed 148 billion budget proposed by acting-County Executive Elijah Johnson.

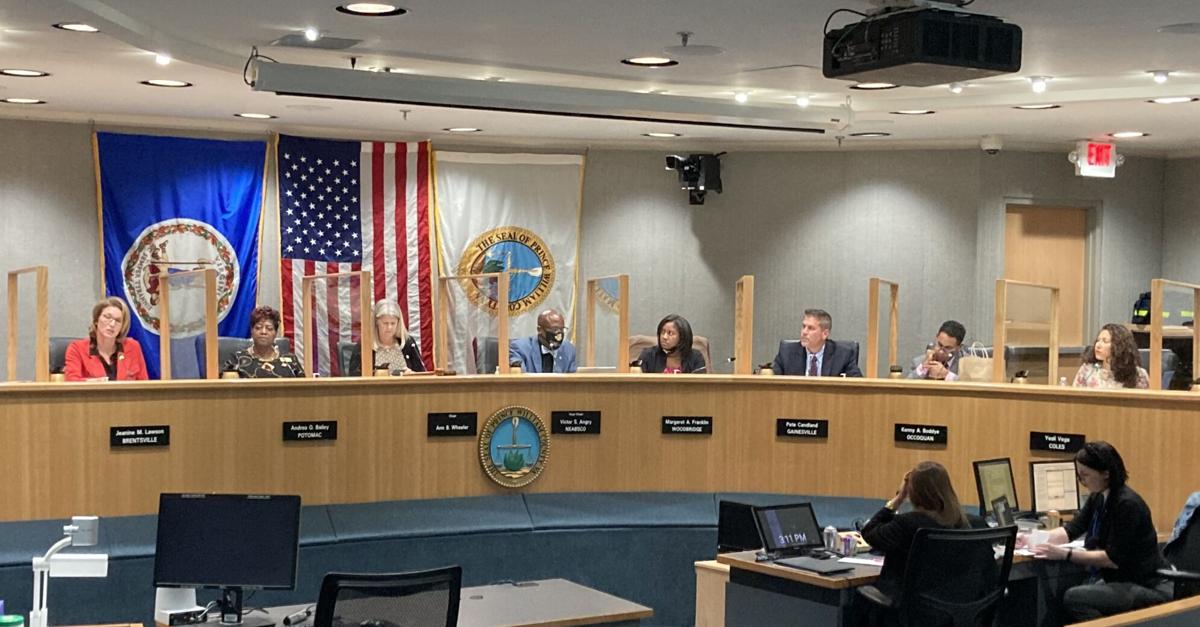

Gop Prince William Supervisors Criticize Tax Increase Headlines Insidenova Com

County Supervisors Adopt 1 34 Billion Budget On Party Line Vote News Princewilliamtimes Com

Pin By Faith Maricic Real Estate On Stop Paying Your Landlord S Mortgage Lead Generation Real Estate Real Estate Leads Home Buying Process

Join Renew Realtor Association Of Prince William

First Half Of 2020 Real Estate Taxes Due July 15 Prince William Living

Personal Property Taxes For Prince William Residents Due October 5

Northern Virginia Residential Property Tax Rates And Due Dates Smart Settlements

Manassas Virginia Old Town Manassas Manassas Virginia Manassas Virginia

%20.jpg)